Create a free account and start investing in startup equity, funds, commodities, real estate, and more!

Invest in carefully vetted investment opportunities

Fund the next generation of world-class startups, projects, funds, and more during their capital raise.

Trade private shares in between capital raises… just like you trade stocks.

Due to regulations, you need to confirm interest to see our investment opportunities

Due to regulations, we cannot proactively market securities to users in your country. However, you can view information about our issuers if you confirm your interest using the button below.

By confirming, you acknowledge that your request comes without being solicited or approached, directly or indirectly, by the issuers therein or any affiliate acting as an agent on their behalf.

Only a select few have had access to the private capital markets.

Securitize Markets is changing that.

What makes us different from other platforms

Cut down on research time by accessing unique - and highly vetted - investment offerings from different asset classes.

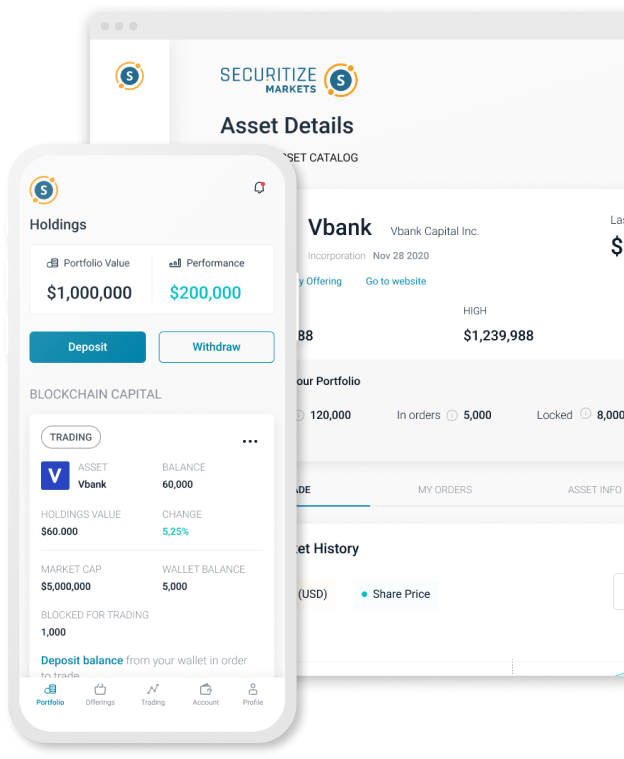

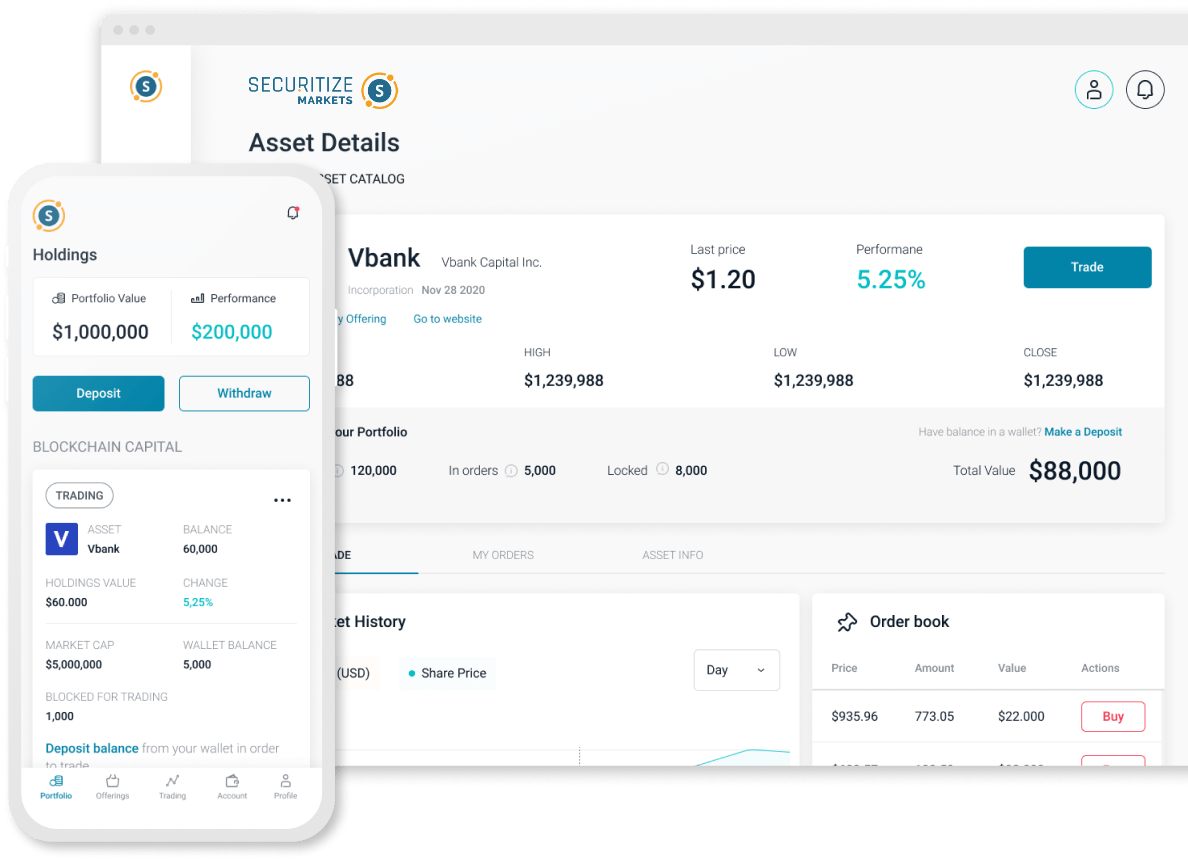

Unlock your net worth with the ability to trade select holdings on our secondary market.

Invest with $0 commissions on primary market investments and market-competitive secondary market trading fees.

Digital Asset Securities are digital representations of traditional financial products such as equity and debt, of which the ownership rights are registered on a blockchain.

Democratizing access to alternative investments through tokenization

Digital Asset Securities, or security tokens, are digital representations of traditional financial products - like equity or debt.

By registering ownership rights on the blockchain, you can truly - and at any given time - prove ownership.

Traditionally it would take an average of around 12 years* to unlock liquidity in Venture Capital investments. Our secondary market unlocks the potential for liquidity.

Trades are settled immediately and are executed by smart contracts, removing transactional risks.

Start investing in 3 steps

1. Create your Securitize iD 2. Fund your account3. Start investing and build your portfolio

As Seen In...

Want to keep up with the

latest investment opportunities?

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.